Looks like China is cracking down on exchanges, and this one (Binance) is based in China, so most folks are pulling their crypto currency out of it and moving it to other exchanges, like US based Coinbase and Poloneix.

If you don't know much about cryptocurrencies, can't blame you...most have only heard of Bitcoin...but there are nearly 1000 out there like it.

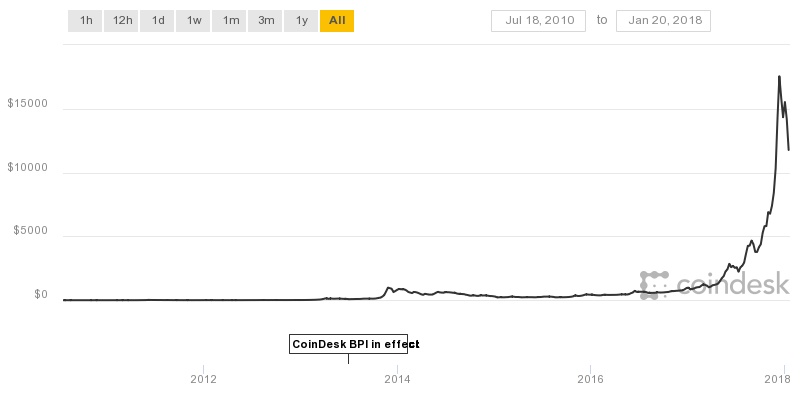

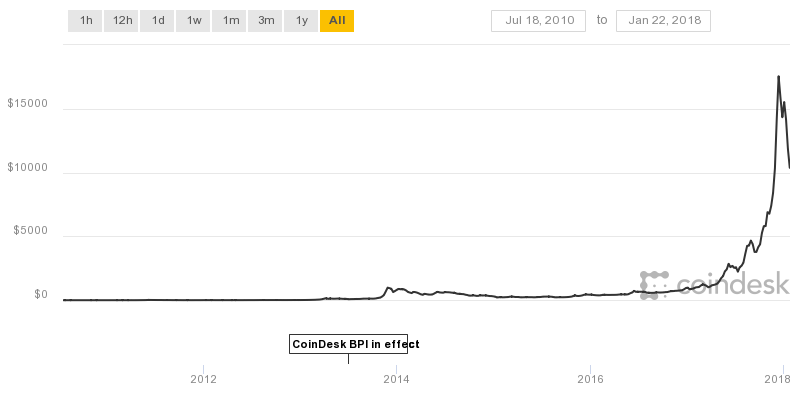

I just recently dipped a toe in it, after the market hit a big low in the beginning of the year. Mostly rumors caused the crash, as this market really responds quickly (and drastically) to FUD (Fear, Uncertainty, Doubt).

For me, realizing that even with the crash, most crypto currencies still had gains of hundreds or even thousands of percent, it made me really want to know more about it for FOMO (Fear of Missing Out).

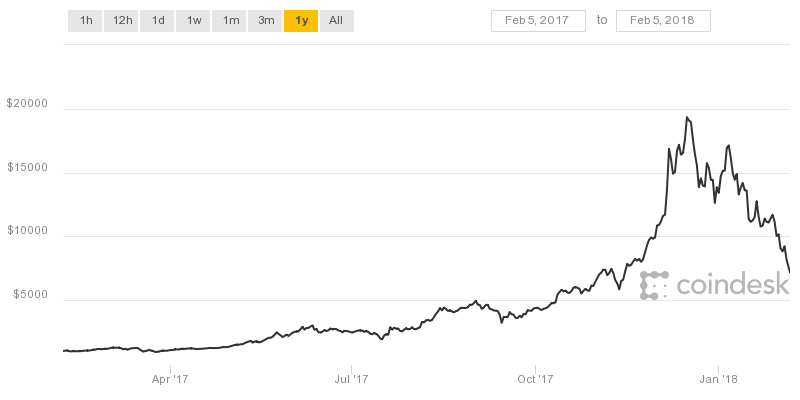

Currently, the market is a bloodbath, crashing amidst fears of China banning exchanges and putting serious restrictions on cryptocurrencies. South Korea and Japan (also large crypto markets) are considering similar means as well.

But, most of us believe in the idea of HODL (Hold On for Dear Life), just holding onto it and waiting for the currencies to again go back up. I just dipped my toe in it, less than $200 invested, to see what would happen over the course of a month first. Boy, did I pick a weird month....lol.

EDIT: Yes, I purposefully worked these new acronyms into this post, as these seem to come up a LOT when looking at crypto articles, so sucks if you don't know them, lol.

If you don't know much about cryptocurrencies, can't blame you...most have only heard of Bitcoin...but there are nearly 1000 out there like it.

I just recently dipped a toe in it, after the market hit a big low in the beginning of the year. Mostly rumors caused the crash, as this market really responds quickly (and drastically) to FUD (Fear, Uncertainty, Doubt).

For me, realizing that even with the crash, most crypto currencies still had gains of hundreds or even thousands of percent, it made me really want to know more about it for FOMO (Fear of Missing Out).

Currently, the market is a bloodbath, crashing amidst fears of China banning exchanges and putting serious restrictions on cryptocurrencies. South Korea and Japan (also large crypto markets) are considering similar means as well.

But, most of us believe in the idea of HODL (Hold On for Dear Life), just holding onto it and waiting for the currencies to again go back up. I just dipped my toe in it, less than $200 invested, to see what would happen over the course of a month first. Boy, did I pick a weird month....lol.

EDIT: Yes, I purposefully worked these new acronyms into this post, as these seem to come up a LOT when looking at crypto articles, so sucks if you don't know them, lol.